when are property taxes due in chicago illinois

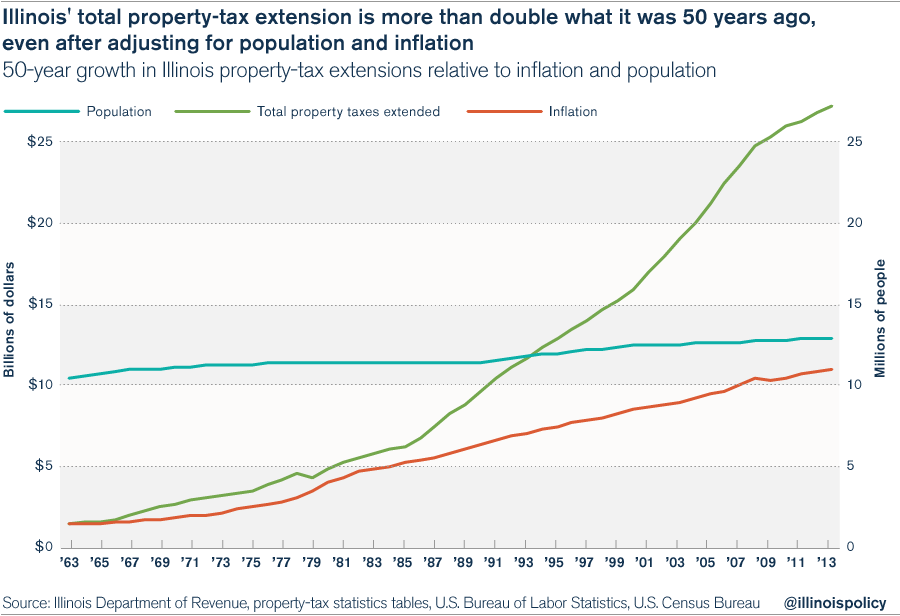

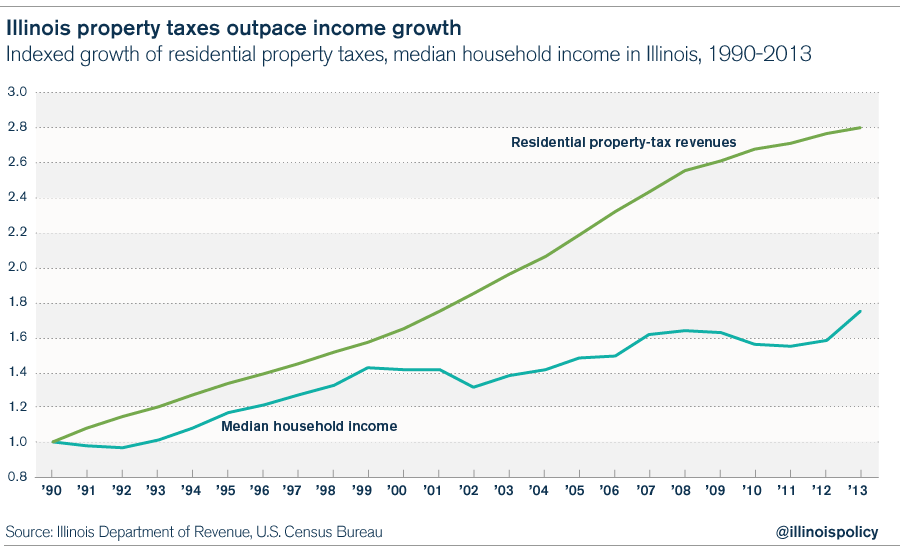

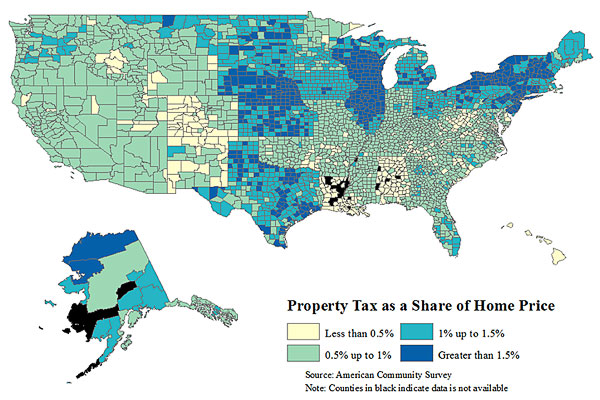

There are three basic phases in taxing real estate ie setting levy rates estimating property values and receiving payments. In Chicago property taxes have grown more than 3 times faster than inflation for 20 years.

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

September 9 2021 Cook County Treasurer Maria Pappas and her office have sent out the second property tax bill installment which is due October 1.

. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. Cook County Treasurers Office - Chicago Illinois Important Dates Due Dates Tax Year 2021 Second Installment Property Tax Due Date. Reduce property taxes for yourself or others as a legitimate home business.

Fast Reliable Answers. 173 of home value Tax amount varies by county The median property tax in Illinois is 350700 per year for a home worth the. By Mike Nolan.

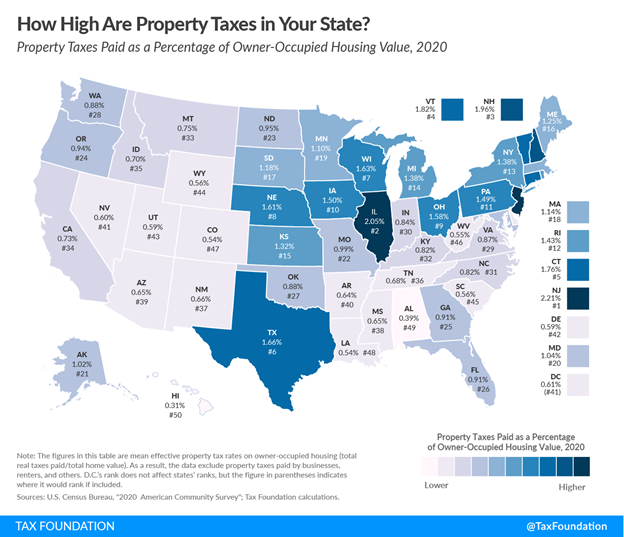

Chicago mayors have a history of inflating budget shortfalls after an. Illinois was home to the nations second-highest property taxes in 2021. A battle over your.

Due Dates Tax Year 2021 Second Installment Property Tax Due Date. Job in Chicago - Cook County - IL Illinois - USA 60290. Odds are growing that the due date on 16 billion in Cook County property tax bills will be Dec.

Oct 23 2022 at 530 am. Has yet to be determined. Accorded by Illinois law the government of Chicago public.

100s of Top Rated Local Professionals Waiting to Help You Today. Late payments will be. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Ad Leading Federal Tax Law Reference Guide. CHICAGO WLS -- Your upcoming Cook County property tax bills will likely not get to you by August 1. Property taxes in the Chicago region.

The Tax Year 2021 Second Installment Property Tax due date has yet to be determined. There is controversy between three Cook County offices. Chicagos property taxes tied to.

Tax Due Dates Extended Due To Covid-19. Restaurant Tax guidance for. Ad Reduce property taxes for yourself or residential commercial businesses for commissions.

The county said second installment bills will come before the end of the year. The first installment of property tax bills in 2023 is expected to be due March 1. Cook County Treasurers Office - Chicago Illinois TAX BILL UPDATE.

It is managed by the local governments including cities counties and taxing districts. The Illinois Department of Revenue does not administer property tax. Right now the owner of a median-priced home pays 36 to 47 in property taxes per year to the district.

The mailing of the bills is. Then just a few months later the first installment of 2023 will be due. If the referendum passes the increase for an average homeowner.

Banking and Finance Financial. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. If you are a.

Youll likely get your property tax bill this yearbut only barely. Pappas and ABC 7 Chicago to honor Juneteenth by hosting sixth Black and Latino Houses Matter phone bank on June 15. In most counties property taxes are paid in two installments usually June 1 and September 1.

March 1 2021 Cook Countys first property tax payments are due March 2. The Illinois State Capitol Antonio Perez Chicago Tribune Candidates for Illinois House district seats in the. The Portal consolidates information and delivers.

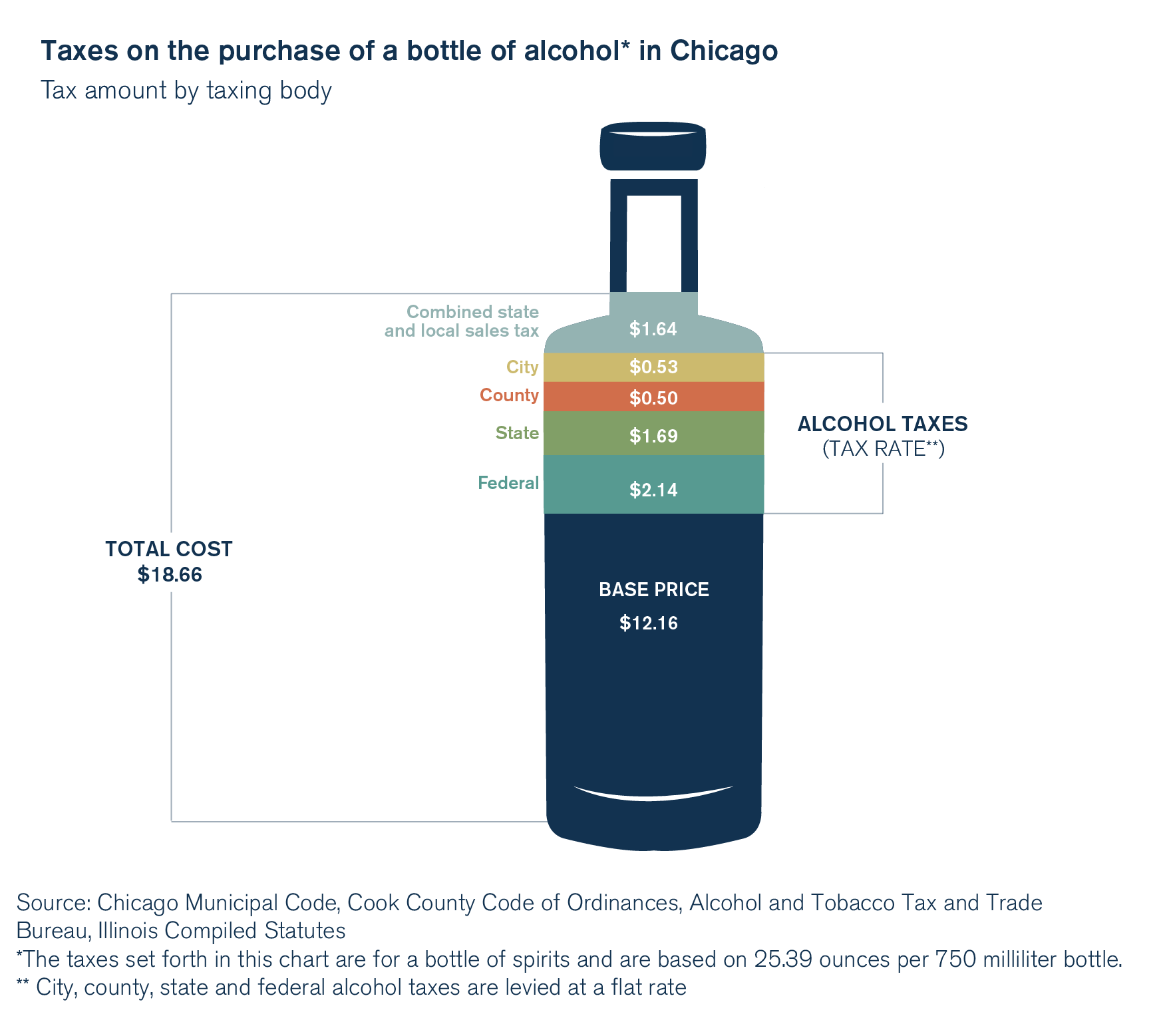

Illinois Property Taxes Go To Different State 350700 Avg. For more information about taxes in Chicago you may visit the Tax Division of the.

Everything You Need To Know About Property Taxes In Illinois

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

Commercial Property Owners Want An Equitable Balance Crain S Chicago Business

Second Installment Of 2021 Tax Bills In Cook County Will Be Due By Year S End

Home Is Where The Hurt Is How Property Taxes Are Crushing Illinois Middle Class

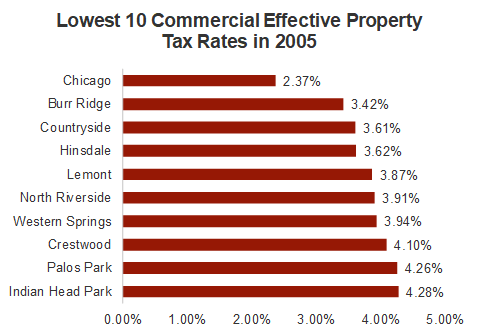

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

New Report Illinois Property Taxes Among Highest In Nation The Civic Federation

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

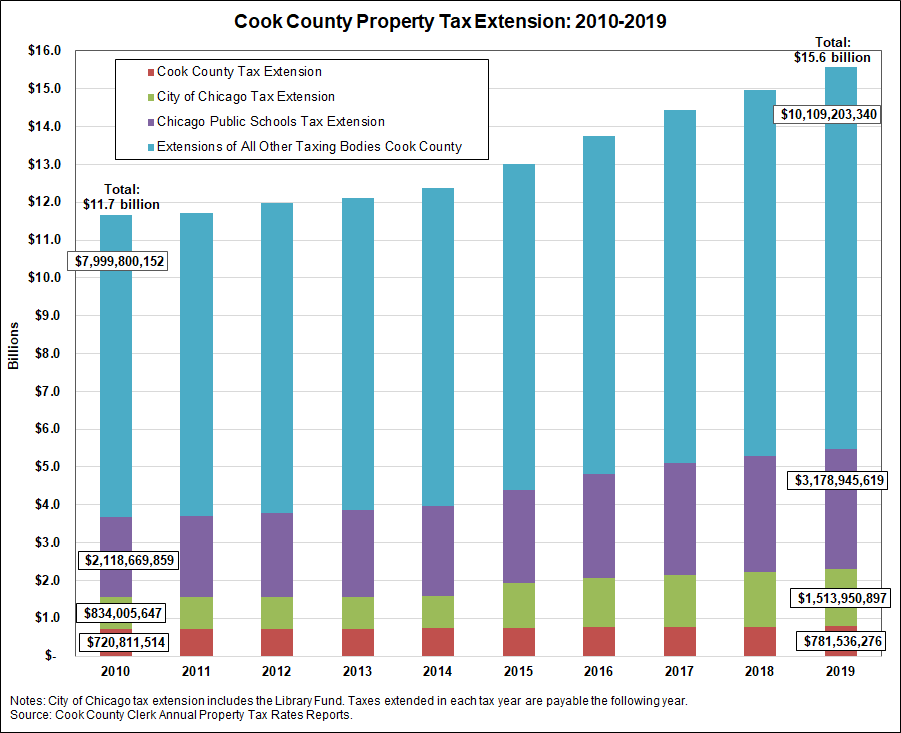

Cook County S Property Tax The Civic Federation

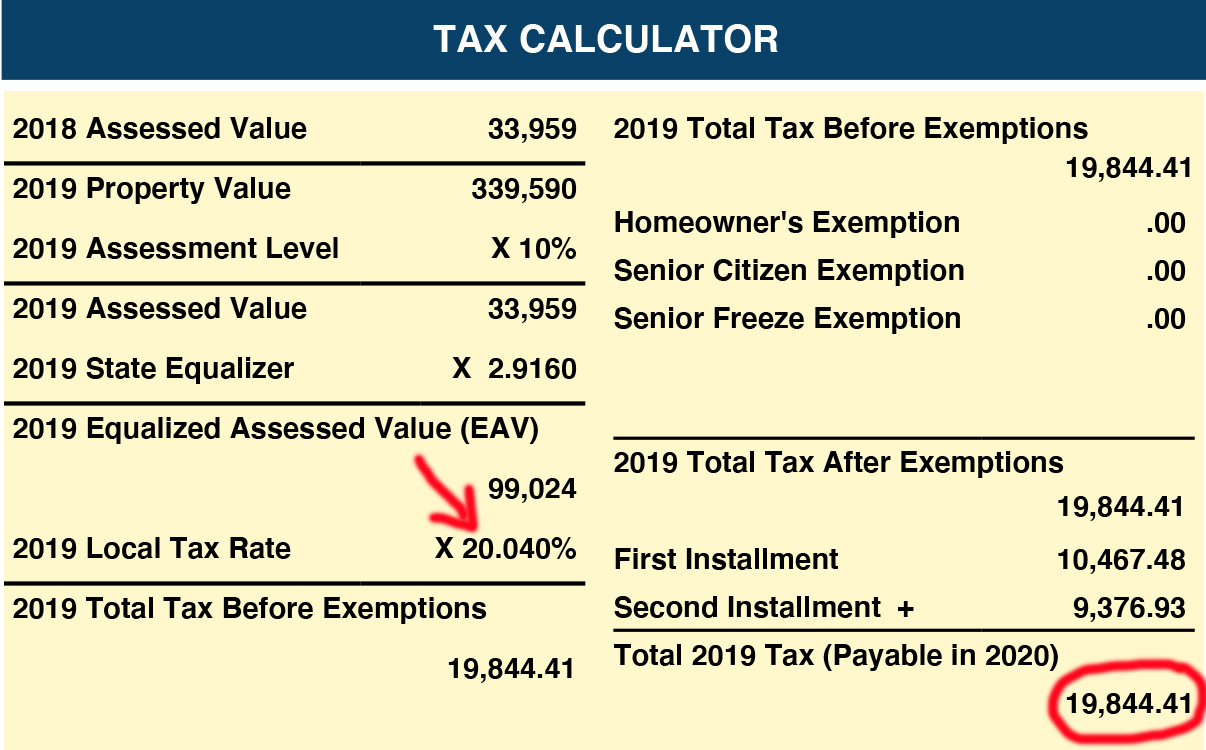

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Pilsen Planning Committee Housing Task Force Led By Trp To Host Educational Workshop Urging Homeowners To Appeal Property Taxes Prior To September 25th Deadline The Resurrection Project

Cook County Treasurer Posts First Installment Of Property Tax Bill Chicago Association Of Realtors

Fix Or Sell Illinois High Property Taxes Make Either Tough

Analysis Lincoln Park Pays Property Taxes 1 43 Times National Average Chicago City Wire